Inflation Reduction Act

For installations of eligible equipment occurring after January 1, 2023, homeowners may receive a nonrefundable credit against their taxes for an amount equal to the sum of: • 30% of the total installation costs of eligible equipment up to $1,200 per taxable year. • The credit for eligible heat pump installation costs is capped at $2,000; these costs are considered separate from the $1,200 annual limit.

How Does the Inflation Reduction Act Work?

Keep in mind that this story is intended only as a guide, but here’s a summary of the Inflation Reduction Act and how it could help homeowners save on Day & Night® heating and cooling products.

Essentially, the Inflation Reduction Act offers IRS Section 25C tax credits for qualified energy efficiency improvements and/or the installation of eligible heating and cooling equipment through December 31, 2022.

The tax credit applies only to qualifying expenditures for an existing home or addition/renovation to an existing home. In certain situations, labor costs may be included while calculating the IRS Section 25C credit for on-site preparation, assembly, or original installation.

This tax credit can’t be applied for new construction.

Through December 31, 2022, homeowners may be eligible for a credit against their taxes for an amount equal to:

- Ten percent of the amount paid or incurred during the taxable year, up to $500 or a specific amount from $50 to $300, depending on the heating and cooling equipment installed.

- The amount of the residential energy property expenditures paid or incurred during the taxable year.

- The IRS Section 25C tax credit is retroactive to January 2018. Homeowners may choose to amend their taxes to take advantage of the tax credit.2

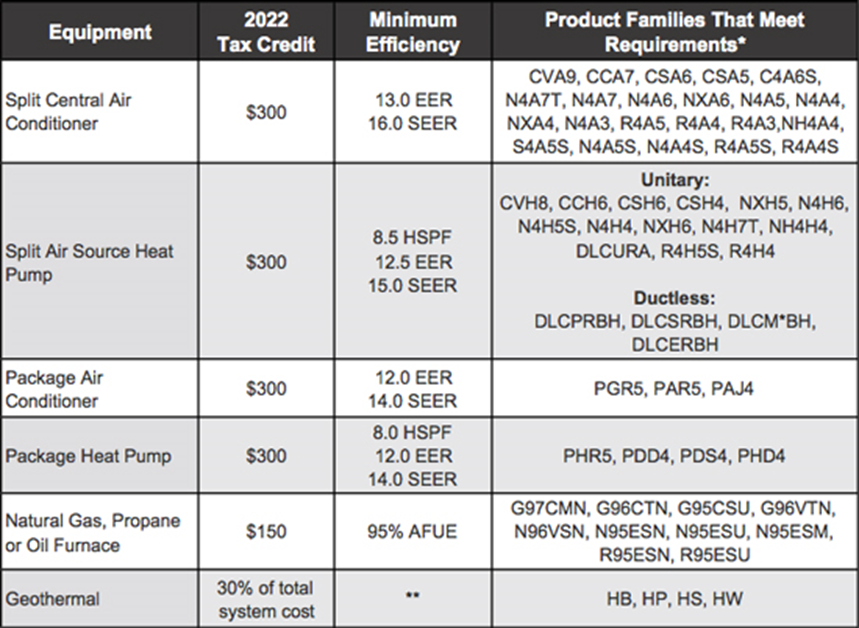

Which Day & Night® Products Qualify for These Tax Credits?

Several Day & Night® heating and cooling products may qualify for the IRS Section 25C tax credits under the Inflation Reduction Act, including high-efficiency ACs, heat pumps, SPPs, and gas/propane/oil furnaces. Energystar.gov has some great resources. Click here for more details.3

Day & Night® Products That May Qualify for Tax Credits

*Qualification depends on the specific model and system combination installed. Consult the AHRI® Directory or www.ICPeqp.com/default.aspx for a list of applicable combinations.

Should I Mention the Inflation Reduction Act in My Conversations with Homeowners?

Absolutely! For homeowners, the Inflation Reduction Act, and IRS Section 25C tax credits make heating and cooling equipment more affordable. With these tax credits, consumers could install a high-efficiency Day & Night® home comfort system that provides the following benefits:

- Potential energy savings on heating/cooling bills

- Ion™ System communication capabilities

- SmartSense™ Technology with enhanced humidity control

- Application flexibility of ductless single-zone or multi-zone solutions

- Custom, variable-speed comfort at home.

Today, we’ve discussed the Inflation Reduction Act, including IRS Section 25C tax credits for qualifying Day & Night® equipment. In future conversations with homeowners, it’s important to mention the Inflation Reduction Act and how it could make the purchase of high-efficiency heating and cooling equipment more affordable.

2 No guarantees are given or implied in this story regarding the eligibility of an individual to receive tax credit under these programs or how such credits would apply. Please consult a tax professional to determine eligibility for and application of the credit(s).

3 https://www.energystar.gov/about/federal_tax_credits

All trademarks are the property of their respective owners. Information copied from https://dayandnight.hvacpartners.com/stories/inflation-reduction-act-of-2022